Executive Summary

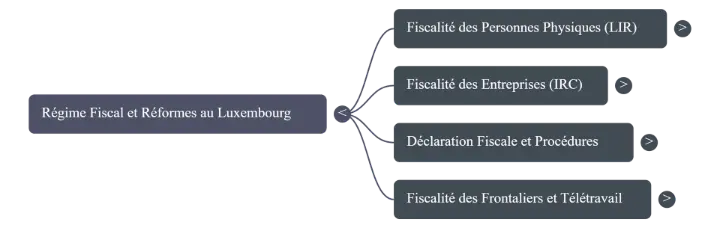

Luxembourg tax landscape is undergoing significant change, driven by the aim of strengthening economic competitiveness while introducing targeted social adjustments. Current reforms and debates revolve around several key areas: reducing the tax burden on individuals through revised brackets and tax credits, overhauling corporate taxation to align with international standards, and modernizing administrative procedures through digitalization.

Key measures for individuals include adjusting the tax brackets to partially offset inflation, introducing specific tax credits such as the Tax Bracket Credit (CIB) and the Overtime Tax Credit (CIHS), and increasing support for single-parent families via the Single Parent Tax Credit (CIM). However, these adjustments are considered insufficient by stakeholders such as the Chamber of Employees (CSL), which advocates for an automatic indexation mechanism for tax brackets and more ambitious measures to ensure social justice.

For businesses, the main measure is a reduction in the Corporate Income Tax (IRC) rate aimed at improving Luxembourg’s attractiveness. This initiative is welcomed by the Chamber of Commerce, which nevertheless calls for a broader reform and a long-term “road map” to remain competitive against jurisdictions such as Ireland and Switzerland. In parallel, the tax framework is adapting to post-BEPS international standards, with a focus on transfer pricing rules, reverse hybrid entities, and substance requirements.

Finally, cross-cutting themes such as tax optimization for executives (salary/dividend arbitrage), multiple deduction mechanisms for taxpayers (housing savings, retirement schemes), and the complex tax framework of teleworking for cross-border workers remain central and recurring elements of the Luxembourg tax system. Digitalization, particularly through mandatory electronic filing, is presented as a simplification tool, though its effective implementation is approached cautiously by various stakeholders.

I. Tax Reforms for Individuals

Recent bills, notably draft law n°8388, introduce several changes aimed at easing the tax burden on households, supporting purchasing power, and addressing specific situations, particularly those of single-parent families and cross-border workers.

A. Adjustment of Tax Brackets and New Tax Credits

One of the central measures is the adjustment of tax brackets to account for inflation.

- Tax Bracket Adjustment for 2025: Brackets will be adjusted by two and a half index tranches (6.37%), benefiting mainly low- and middle-income households. For example, for a taxable income of €50,000, the estimated tax relief is 8.5%.

- Introduction of the Tax Bracket Credit (CIB): For the 2024 tax year, a CIB is introduced to offset the loss of income following the expiry of the 2023 Conjunctural Tax Credit (CIC). This measure specifically targets taxpayers in classes 1a and 2 who would otherwise face financial losses. The Chamber of Civil Servants and Public Employees regrets that the credit is limited to 2024 only.

Comparison of Tax Brackets (Class 1): 2024 vs. 2025

| Tax Rate | 2024 Bracket | 2025 Bracket |

| 0% | 0 – €12,438 | 0 – €13,230 |

| 8% | €12,438 – €14,508 | €13,230 – €15,435 |

| 9% | €14,508 – €16,578 | €15,435 – €17,640 |

| … | … | … |

| 42% | > €220,788 | > €234,870 |

The Chamber of Employees (CSL) strongly criticizes this approach, arguing that to fully compensate for “bracket creep” since 2017, the adjustment should have been six index tranches, not 2.5. It calls for the reinstatement of an automatic, annual indexation mechanism.

B. Measures for Families and Low-Income Earners

Specific measures target single-parent families and low-wage workers.

-

Single Parent Tax Credit (CIM):

- The maximum CIM will increase from €2,505 to €3,504 from 2025.

- Available for gross annual income up to €60,000, then decreases linearly to €750 at €105,000.

- The CSL notes that while the maximum has increased 367.33% since 2009, the minimum €750 has remained unchanged, losing real value.

- It also recommends automatic allocation of the CIM to reduce non-take-up of benefits.

-

Minimum Wage Tax Credit (CISSM):

- From 2025, the CISSM will increase from €70 to €81 per month for gross monthly wages between €1,800 and €3,000.

- The CSL welcomes this but regrets no action was taken for 2024, when minimum-wage earners became taxable again.

C. Specific Situation of Cross-Border Workers

The situation of cross-border workers, particularly Germans, led to the creation of a new tax credit.

-

Introduction of the Overtime Tax Credit (CIHS):

- Context: German authorities decided to tax overtime worked in Luxembourg by German residents, though these are tax-exempt in Luxembourg.

- Objective: Partially offset the resulting net income loss and maintain Luxembourg’s attractiveness for cross-border labor.

- Mechanism: CIHS can reach up to €700 per year for employees earning over €4,000 in overtime pay.

- Justification: According to Finance Minister Gilles Roth, this amount was calculated to cover German taxes for about 80% of the 20,149 German cross-border workers who performed overtime in 2022.

- Criticism by CSL: CSL deems the amount insufficient and proposes an alternative: giving workers the choice to have overtime taxed in Luxembourg, which would resolve Germany’s concerns about double non-taxation.

D. Digitalization and Administrative Simplification

The reform also aims to modernize interactions between taxpayers and the administration.

- Mandatory Electronic Filing: Article 152 of the law is amended to require electronic filing of withholding tax returns.

- Feedback from Professional Chambers: Both the Chamber of Commerce and CSL welcome the initiative but stress it must genuinely simplify processes and not create burdens for reporting entities.

- Development of MyGuichet: The Chamber of Commerce recommends further digitalization of forms, expanding MyGuichet functionalities, and simplifying the dematerialization of tax notices.