Why should you choose to incorporate your Holding Company in Luxembourg?

Parent-Subsidiary regime

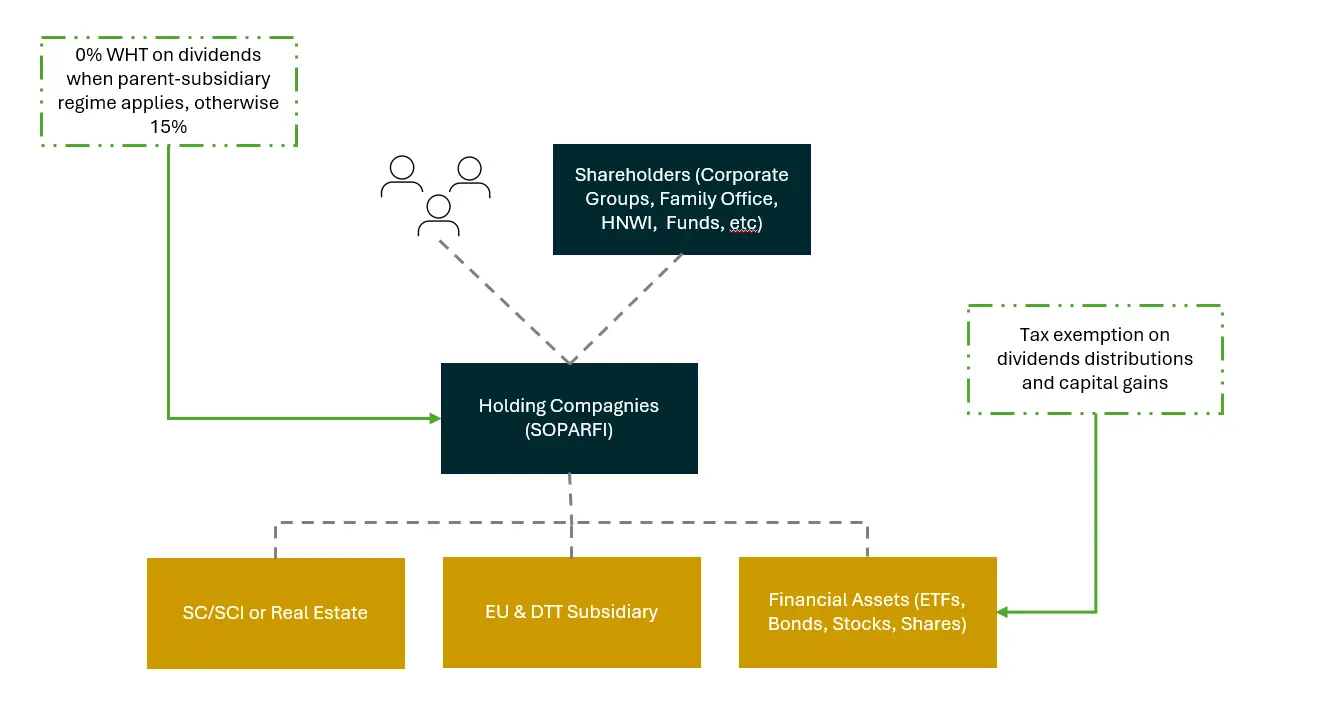

One of the main reasons investors and entrepreneurs choose Luxembourg for their holding company (SOPARFI) is the exceptional tax advantage offered by the Parent-Subsidiary regime, also known as the Participation Exemption.

In simple terms, this regime allows your Luxembourg company to receive dividends and sell shares from subsidiaries with little to no corporate tax impact. If your SOPARFI holds at least 10% of another company’s shares, or has invested at least EUR 1.2 million in it (for dividends) or EUR 6 million (for capital gains), and keeps this participation for at least 12 months, the income and gains can be fully exempt from tax in Luxembourg.

This structure is designed to help you reinvest profits efficiently within your group or repatriate earnings to shareholders without losing value to double taxation. It turns Luxembourg into a powerful platform for managing international investments, acquisitions, and group financing while keeping administrative requirements simple and predictable.

In short, the Participation Exemption regime allows you to grow and restructure your business across borders while preserving nearly all of your returns at the holding level—a key factor in why Luxembourg remains one of Europe’s most trusted hubs for corporate and private investment planning.

Tax Regime

A Luxembourg SOPARFI is a fully taxable company, which means it is subject to the standard corporate tax framework in Luxembourg. This includes three main taxes:

Corporate Income Tax (CIT)

Municipal Business Tax (MBT)

Net Wealth Tax (NWT)

In practice, the combined effective tax rate for a SOPARFI based in Luxembourg City is approximately 24.94% on higher profits.

While this may seem comparable to other European jurisdictions, the real advantage of the SOPARFI lies in how this taxation interacts with Luxembourg’s broad network of double tax treaties and the Participation Exemption regime. These mechanisms significantly reduce or even eliminate taxation on dividends, capital gains, and foreign-source income, allowing the structure to remain both compliant and highly efficient.

In essence, the Luxembourg SOPARFI offers the stability and credibility of a fully taxable company while providing exceptional opportunities for international tax optimization and reinvestment planning.

Double Tax Treaties (DTTs)

Luxembourg has signed double tax treaties with more than 80 countries worldwide, ensuring secure cross-border financial flows and preventing double taxation.

As a fully taxable entity under Luxembourg law, a SOPARFI benefits from this extensive treaty network and can also apply the EU Parent-Subsidiary Directive. This combination provides strong legal and fiscal protection for international investors, facilitating efficient profit repatriation and minimizing withholding taxes on dividends and other income.

Asset Protection and Flexibility

Setting up a Luxembourg holding company allows investors to isolate strategic assets such as shareholdings, intellectual property, or real estate (through subsidiaries) from the operational risks of their trading entities.

Through common legal forms like the SA (public limited company) or SARL (private limited company), shareholder liability is strictly limited to their capital contribution. This structure combines asset protection, legal security, and flexibility, making it a preferred tool for both corporate and private investors managing international assets.

Example of Structure Chart

- Ideal for receiving or granting financing

- Raise capital for investment

- Issue bonds or debt securities

- Listing in Luxembourg

- Invest in Intellectual Property

Comparison with France, Belgium and Germany

Luxembourg is widely regarded as a leading European jurisdiction for holding structures, offering exceptional flexibility in dividend repatriation and the management of international financial flows. Compared to neighboring countries, it provides a more efficient and predictable framework for optimizing group cash flows and structuring cross-border investments.

Upcoming changes in legislation amongst European Countries are not good indicator for Holding Companies, however Luxembourg remains stable, in accordance with its Triple A rating.

France: Tax Holding PLF 2026

Get in touch

"At The BOARD Luxembourg, we strive for Excellence, we set the Standard."

The B.O.A.R.D Luxembourg

+352-621-165-660

contact@theboardluxembourg.com

70 Rte d'Esch · 1470 Hollerich · Luxembourg